The surge of profit after tax to N18 billion in 2022 as against N6.08 billion in 2021 headlined the 45th AGM of 11Plc. Platforms Africa sought and brought shareholders’ side of the story.

11 PLC had its 45th Annual General Meeting, where the company announced 200 per cent growth in profit after tax to N18 billion in 2022 as against N6.08 billion in 2021.

The results posted by the foremost Nigeria downstream company showed that it has been growing in leaps and bounds over the years. The event offers a veritable avenue to appreciate the unalloyed support and cooperation of its esteemed shareholders and other stakeholders in the 2022 financial year as well as posit an insight into the future of the company. Beyond reports of rising profits, Platforms Africa sought shareholders’ Side of the story.:

Barrister (Mrs ) Adetutu Siyanbola – Chairperson Highly Favoured Shareholders Association

The financial highlight of the company for the year ended December 2022 is quite impressive and gladdening to investors even in the face of the harsh economic realities 9d the nation . Particularly interesting to shareholders is the meteoric rise in the revenue profile of the company, jumping from 243,457,406 to 371,899,701 ,a leap of 53%.

READ ALSO: 11 Plc Positions Investments, Assets For Downstream Market Leadership

BREAKING: AIT Founder Raymond Dokpesi is Dead

Oil theft: Nigeria Releases Seized Norwegian Oil Tanker After Plea Bargain

Mother Slumps, Dies After Hearing News of Son’s Demise In Auto Crash

BREAKING: Fuel Subsidy is Gone, Tinubu Declares

Although she commended the yearly dividend payout of the company retained at N8.50k for the financial year ended December 31,2022 , an appeal was made to the Board to raise it a bit to further put smiles on the faces of the shareholders .

Expressing deep gratitude for the increased corporate social responsibility of the company which has transversed several socio -economic facets of life of the populace ,she pleaded for more youth empowerment by way of creating jobs fir the teeming millions of unemployed youth across the country .

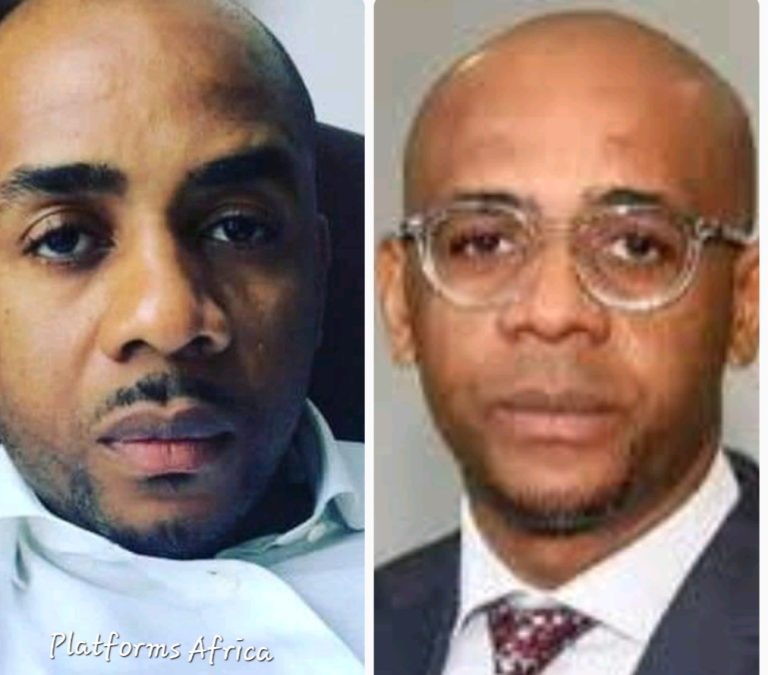

Alhaji Sani Yau Babura – MD / CEO Sani Yau Enterprises

The financial report, as presented by Board Chairman ,11plc, vindicates the rising profile of the company since 2017 when the new investors acquired 60% majority stake of ExxonMobil shares in Mobil Oil of Nigeria plc

The growth ,he noted, is really not a fluke but a strategic action of the company’s management and board through well thought investment in both human and capital resources . Citing some of the notable investment which are gradually yielding fruits now to include the LPG plant improving access to domestic cooking gas ,it’s great re entry into the aviation market nor ranking far higher than it’s peers in the sector .

Delighted with the dividend offer for the year ,Sani said it’s commendable and further shows the proactively of the Board expecially when taking in to consideration the urgency of saving for rainy day as cost of funds in the money markets is skyrocketing by the day as it may be counter productive depending on such funds when avenues of funds from retained profits can be used to finance such projects .

With more funds for development, the sky will be the limit for the growth potentials of 11Plc

Mr Augustine Ezechukwu – President Capital Shareholders Association of Nigeria

Commended the largely improved communication between the company’s management and shareholders describing the dissemination regarding the operations and management of the company to shareholders as been very timely ,accurate, and continuous. Citing the yearly annual report ,he said members of his Association got in very good time the Annual report for the year ended December 31,2022 this giving them.smole opportunity to disect the documents for a better informed reaction at today’s event

He is pleased for the return of investors involving shareholders to give room for more cross fertilisation off ideas between investors and management of the company .

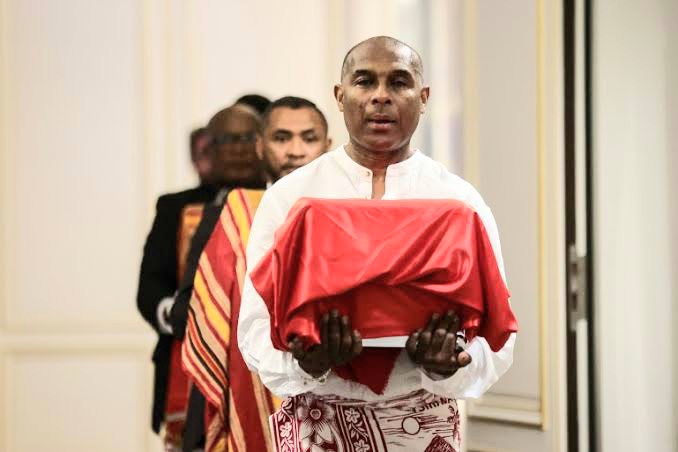

Response by MD/ CEO 11plc – Adetunji Oyebanji

The CEO pledged that the company will continually strive to improve the lots of its esteemed investors through regular payment of dividends and better returns of investment with a proviso that the operating environment improves .

The dividend policy is that of saving for the rainy day, especially with the eventualities of subsidy removal in premium motor spirit popularity known as petrol . With the imminent removal cost of doing business will definitely go up a d in such instance, the company might be forced to seek more funds to run the business with internals’ funds earlier generated coming handy as buffer.

On CSR ,he said the company will look into the suggestion on youth empowerment even as the company has s caught them.young policy on sports development through grassroot sponsorships of sporting activities I we the years .

He promised an inspiring bright and fulfilling future due to the company and the country in general.

“We are fully set for whatever policy directives with regards in the sector and are well poised to take advantage of it in the overall interest of our esteemed investors and customers alike. Whatever policy directives of the incoming administration, especially at the federal level.

“Looking forward, we see an inspiring bright and fulfilling future for our company and the country in general.”

Oyebanji thanked the shareholders and other esteemed stakeholders for attending the physical AGM after a long while, no thanks to the COVID-19 pandemic.

“Our deep appreciation also goes to our customers who have stood with our brands over the years with an assurance that the confidence reposed in us shall not be taken for granted. Also worthy of thanks are my management team and the entire staff who have continued to deliver industry leading performance.”

Of this ignoble act.

Our hospitality firm, Lagos Continental Hotel, is also making giant strides by offering excellent services to its growing customers and competing favourably with its peers in the industry. We have remained a socially responsible organization in all ramifications either in our host communities or with relevant government agencies.”

Result

Despite the harsh operating environment in 2022, the company’s profit after tax also grew by 200 per cent to N18 billion in 2022 as against N6.08 billion in 2021. “We are exhilarated with our performance in the year under review even though there is still room for improvement given our growing investment in human and capital resources. With the growing pedigree in all our business lines, we are upbeat about improved performance in subsequent years.”

People

Oyebanji made it known that the company’s greatest asset in meeting the vision of the company remains the workforce. 11 PLC shall continue to place a premium on its human capital and ensure that they key into the growth trajectory. As part of efforts to improve deliverables by the workforce, it has continually trained them at various levels taking advantage of whatever human capacity development facilities are available in Nigeria.

He thanked the management team and entire staff without whom he would not have delivered exemplary performance.

The Future

“As we approach 2023, being an election year, we would not be averse to a change in policy direction. However, we are advocating for a position that gives room for a level playing ground for all operators. What we always clamour for is to have a free market. People talk about deregulation from different perspectives but there will always be regulation at least in the areas of health, safety and product quality. However, regulation should not apply to the pricing and sourcing of products.

We believe that a policy change might be imminent and we are very optimistic that with the investment already made by the company, 11Plc is well poised to take advantage of whatever policy directives of the incoming administration, especially at the federal level.

Looking forward, we see an inspiring bright and fulfilling future for our company and the country in general.”

Oyebanji thanked the shareholders and other esteemed stakeholders for attending the physical AGM after a long while, no thanks to the COVID-19 pandemic.

“Our deep appreciation also goes to our customers who have stood with our brands over the years with an assurance that the confidence reposed in us shall not be taken for granted. Also worthy of thanks are my management team and the entire staff who have continued to deliver industry leading performance.”