About a third of the way into the book, Otedola delivers a staggering claim with characteristic breeziness: “I soon controlled 93% market share [of diesel].” This apex of dominance was likely reached five years after Zenon’s founding and the very year he states he became a billionaire. The reality, however, as pieced together from contemporaneous reports and policy analysis, reveals a far more complex machinery at work

How does one truly ‘make it big’ in Nigeria? Here, ‘big’ is not merely comfortable or affluent; it is the rarefied air of the dollar billionaire, a status which Femi Otedola, by all accounts, has not only achieved but has come to epitomise. The answer is far from obvious, for if it were simple, the path would be well-trodden by now. Perhaps we can begin by eliminating what not to do.

You need not invent anything. That is a waste of precious time. Pouring vast sums into research and development to pioneer a new product or refine an existing one is equally unnecessary. Consider our paragon of indigenous entrepreneurship, Aliko Dangote; his colossal Dangote Cement has not spent a hollow cent on R&D in at least five years, yet it remains one of the most profitable industrial concerns on the planet. You do not even require a profound knowledge of the product you are selling – leave such quaint notions to misguided entrepreneurs in other countries.

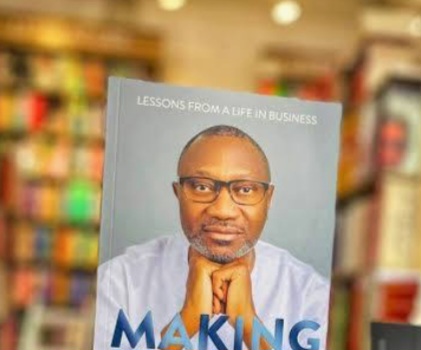

So, what is the secret? To paraphrase a favourite internet meme of mine: when you make it big in Nigeria, you might not tell anyone how you did it, but there will be signs. And in Femi Otedola’s entertaining new memoirs, Making It Big: Lessons from a Life in Business, those signs are present on almost every page.

How a fortune was made

In his own telling, Otedola’s entrepreneurial spirit was not so much learned as it was innate, an irrepressible force that manifested from childhood. He recounts offering manicures and pedicures to visitors at his family home – a nascent businessman identifying an unmet demand and charging for its fulfilment. This instinctual drive was paired with a clear-eyed, almost startling, self-awareness about his academic limitations. He readily admits to a lack of scholarly brightness, conflating primary school performance with the entirety of ‘academia’, for which he held no interest. In a move that would cause most middle-class Yoruba parents profound anguish, he made the choice to forgo university. Remarkably, he was supported in this by his father, Sir Michael Otedola, and instead joined the family printing business, rising to become its managing director by the age of twenty-five.

This early path, however, was merely a prelude. With N10 million – a sum whose provenance is left unexplored – he established Centre Force in 1994, a venture he describes as part loan company, part investment vehicle. The memoir paints a picture of a lucrative, if somewhat nebulous, operation, buoyed by ‘juicy’ car supply contracts secured through military contacts (he was the son of a former governor after all) and a general talent for commerce. It was a life of evident success; by 1997, he was driving a Mercedes Benz and could casually loan his wife, Nana, N40 million to found her own business, Garment Care, after a marital argument.

Yet, for all its profitability, Centre Force appears in the narrative as a prelude to the main event. Otedola himself credits luck for its success and confesses he was no model for his staff. A telling sense of boredom set in, culminating in a moment of sharp introspection when his young daughter answered the question “what does your father do?” with a single, devastating word: “Sleeping.” Her reasoning – that he was never out of bed before 11am, long after she had left for school – pierced through the complacency of his comfortable success. He recognised that for all the money it made, Centre Force was not a ‘proper business’. This restlessness and ambition for something more substantive and legacy-defining, propelled him to establish Zenon Petroleum and Gas in 1999. With an initial N15 million from ‘savings’ and a crucial £250,000 loan from his father at a generously soft 1% interest rate, he embarked on the venture that would generate his first million dollars by 2000 and catapult him to his first billion by 2004, aged 41.

It is this breathtaking ascent with Zenon that forms the core of his claim to having ‘made it big’, and it is precisely why it demands a deeper discussion. If the zenith of Otedola’s business journey – the fons et origo, with apologies to Igodomigodo – was this single company, then the central lessons of his life must inevitably be unearthed from its story. This is crucial, for while the book is replete with dispensed advice, it is the Zenon narrative that truly holds the key. What was the alchemy that transformed a printing heir and general trader into a titan of oil and gas?

About a third of the way into the book, Otedola delivers a staggering claim with characteristic breeziness: “I soon controlled 93% market share [of diesel].” By his own timeline, this apex of dominance – where “everyone was buying from him” – was likely reached around 2004, a mere five years after Zenon’s founding and the very year he states he became a billionaire. On its face, it is a remarkable tale of entrepreneurial velocity, a testament to sheer effort and business acumen. The reality, however, as pieced together from contemporaneous reports and policy analysis, reveals a far more complex machinery at work.

The critical enabler was a policy shift: the full deregulation of diesel (also known as AGO) in 2004, which formally ended the state owned Nigerian National Petroleum Corporation’s (NNPC) monopoly on importation. Policy, however, merely opened the door; access did the rest. Credible reporting from the era indicates that the Obasanjo administration did not simply level the playing field but actively selected its champions. Zenon was a primary beneficiary, being assigned a significant portion of NNPC’s own import quotas and authorised to market imported products on the state’s behalf.

‘High School Dropout To Billionaire,’ Otedola Reveals Success Without Varsity Degree

Billionaire Otedola’s Daughter, DJ Cuppy, Laments Being Single At 33

NYSC Officials Beg For Quiet Resolution Over Vigilante’s Assault Of Female Corps Member – Soludo

‘You Have 48 Hours,’ Reverse Okanlomo Title Or Face Consequences, Alaafin Warns Ooni

Oriyomi Hamzat Apologizes To Naira Marley, Lifts Two-Year Ban On Marlian Records At Agidigbo FM

This state-conferred privilege was compounded by two further decisive advantages. First, Zenon secured some of the very earliest and largest approvals to import under the new regime. Second, and perhaps most critically, the company obtained an exclusive concession to use a key jetty at Ibafon, operated by the Ibru organisation. For a period, this meant that only Zenon’s vessels could berth and offload at this vital infrastructure, creating a formidable logistical chokehold on the entire market.

It is vital to be precise: there is no public record of a gazetted, nationwide sole-import licence granted to Zenon. What did exist was a potent chain of state actions – early approvals, exclusive infrastructure access, and assigned import rights – that collectively produced an overwhelming, de facto monopoly. By 2004–2005, foreign diplomatic cables were describing Zenon as the country’s largest diesel supplier; by 2008, the respected publication Africa Confidential bluntly characterised its position as a “virtual monopoly on contracts to import diesel.”

This is not to dismiss Otedola’s undeniable hustle and ambition, which the book vividly illustrates. But it firmly contextualises them. The alchemy that transformed a general trader into a titan of oil and gas was a combination of entrepreneurial instinct and the immense, heavy-lifting power of state-bestowed advantage – a detail that, while perhaps less romantic, is essential to any true understanding of how one truly ‘makes it big’ in Nigeria.

It’s raining cash

The fruits of this state-conferred dominance were astronomical. The memoir itself offers a glimpse into the incredible cash flow this virtual monopoly generated. While the exact year is unspecified, Otedola recounts a period – likely around 2002 – where Zenon was realising up to $6 million every month. The most telling detail, however, is his admission that this colossal enterprise was, in his own words, a largely dysfunctional “one-man business” with little formal structure. It was a testament to a market where overwhelming advantage could generate staggering returns almost irrespective of corporate sophistication.

AMCON purchased Otedola’s toxic debt from the banks for N141 billion, forcing the lenders to absorb a haircut of over N80 billion. …The state, which had provided the advantages that built his fortune (subsidy on diesel), now intervened to absorb the catastrophic losses that resulted from his risk

This immense wealth was deployed with an audacity that speaks volumes about its scale. Otedola describes swimming in so much cash that when a competitor died of cancer, he saw an opportunity. He approached the man’s son, who had inherited the business but lacked interest in it, and made an offer that was less a negotiation and more a statement of financial power. For the competitor’s depot – built for N300 million and valued at around N800 million at the time – Otedola simply offered N2.8 billion. This pattern of using capital as a definitive argument repeated itself years later during the rebranding of African Petroleum. When his daughter suggested the name ‘Forte Oil’, only to find it was already registered by someone who had never used it, Otedola’s solution was to instruct his lawyers to pay the man N20 million for the name. It was a premium so vast it bypassed all conventional business logic, a move possible only for someone for whom money was no longer a constraint but a blunt instrument.

This torrent of capital from Zenon became the engine for a breathtaking expansion of his empire. As detailed in the book, the proceeds were rapidly parlayed into a sprawling portfolio of assets. He established Sea Force Shipping and Atlas Shipping Agency to control his logistics, and through a series of strategic acquisitions, became a dominant force in Nigerian finance, securing major shareholdings in a who’s who of the country’s banking sector, including Zenith Bank, UBA, and Access Bank. His ambitions stretched into telecoms (Visafone, NITEL), real estate (FO Properties), and even national infrastructure, with acquisitions of the Nigerian National Shipping Line and involvement in the Kaduna and Port Harcourt refineries. It was a transformation from a diesel importer to a national business titan, all fuelled by the immense, policy-enabled profits of a single, breathtakingly lucrative venture.

It is crucial to recognise that nothing in Otedola’s career before or after has ever approached the scale, velocity, or sheer profit-generating power of Zenon. His life post-crisis has largely been one of managing and living off the rents from the empire that Zenon built. While his memoirs present a life rich with varied ventures, it is only because of this one enterprise – its ascent, its near-collapse, and its state-facilitated rescue – that we are reading a book titled Making It Big. Without Zenon, there is no big to make.

Diesel, where art thou?

To be clear, Nigeria is what it is. Otedola is hardly the first, and will certainly not be the last, to use the state as a primary ladder to immense wealth. There is a weary familiarity to this playbook. And to his credit, he demonstrates a clear-eyed awareness of this dynamic, stating on more than one occasion that “Zenon reached the heights it did because the country was not functioning well.” This admission is refreshingly honest. What I found most striking, however, and ultimately frustrating, was that this insight into systemic dysfunction was not paired with a deep fascination for the system’s product. The near-total lack of what one might call product literacy is glaring. The product itself – diesel – is almost a tertiary character in his story of building a billion-dollar empire upon its trade.

His inspiration, as he tells it, was not a grand vision of energy markets but a personal inconvenience: a power outage in late-90s Lagos led to a diesel shortage. After moving his family into the Sheraton Hotel to escape the darkness and heat, he finally secured a delivery. When the rickety truck arrived, it spilled diesel all over his compound. His reaction was one of anger and determination – not about the chemical composition of the fuel, but about the shoddy logistics of its distribution. “I could do a better job,” he decided. And he did. But beyond this anecdote, there is no technical discussion, no deep meditation on the nature of the product, no evidence of a fascination with its properties or uses. The fuel was merely a vessel, a commodity whose primary value was its arbitrage potential.

This stands in stark contrast to the entrepreneurs Otedola himself cites as inspirations, an example being Ray Kroc, who built McDonald’s without a university degree. Where Otedola sees a kindred spirit in the path of non-formal education, the difference in approach is unmissable. Kroc’s obsession was with the product itself. In his memoir, Grinding It Out, he is consumed by the process of obtaining the perfect french fry, describing it with a fanatic’s reverence:

“A man, with his sleeves rolled up to the shoulders, would plunge his arms into the floating schools of potatoes and gently stir them. I could see the water turning white with starch. This was drained off and the residual starch was rinsed off from the glistening morsels with a flexible spray hose. Then the potatoes went into flexible wire baskets, stacked in production-line fashion next to the deep-fry vats… There was no adulteration of the oil for cooking french fries by the McDonald brothers… Their potatoes sold at ten cents for a three-ounce bag, and let me tell you, that was a rare bargain.”

For Kroc, the product was the religion. For Otedola, the product was simply the medium of exchange. This lack of deep product engagement is not a personal failing but a pervasive feature of the Nigerian business landscape, because the true source of fortune is rarely innovation or product excellence. It is information asymmetry. It is him knowing someone you don’t know. The product is almost irrelevant; it is the conduit through which access and privilege are monetised.

This disconnect is perhaps best illustrated on the rare occasion he strays into what appears to be technical detail. In a passage meant to demonstrate his operational savvy, Otedola stresses the importance of understanding basic conversions, stating: “you needed to be able to divide the tonnage by 1,164 to get the number of litres in each shipment.” The intention is to sound knowledgeable, but the instruction is fundamentally backwards. If one accepts his premise that one tonne of product equals roughly 1,164 litres, the correct calculation to convert tonnes to litres is to multiply, not divide. This is not a mere nitpick; it is a basic error in the foundational arithmetic of his own business. Using his flawed formula on a standard 30,000-tonne cargo would miscalculate the volume by nearly 4,000 barrels, representing a significant financial error. This moment, intended to showcase mastery, inadvertently reveals the opposite: a reliance on rote, and potentially mistaken, rules-of-thumb rather than a deep, intuitive understanding of the commodity itself.

From the zenith to the abyss

To his credit, Otedola is not shy about his use of access and privilege. He names the NNPC officials who granted him favours, details the military contacts that provided ‘juicy’ contracts, and chronicles the influence he peddled. This candour is perhaps the most honest part of the memoir. He provides vivid, first-hand accounts of how this access translated into operational advantage, such as relying on M.T. Onukogu – an NNPC operations manager at the time – to call him at midnight to jump the queue of 40 ships waiting to load at the Atlas Cove jetties. “I could have designated an employee,” he writes, “but I couldn’t guarantee that they too would not be sleeping.” This admission is telling: the crucial asset was the founder’s personal, sleepless vigilance in leveraging his connections. It confirms a central, unspoken rule: in the quest to ‘make it big’ in Nigeria, understanding the product is optional. Understanding the corridors of power is everything.

The zenith of Otedola’s fortune with Zenon coincided with the most catastrophic gamble of his career. In the book, he recounts the episode under the telling heading, “What happened when I ignored my inner voice.” The story is one of breathtaking hubris: at the very peak of the market in 2008, with oil prices hitting a historic $147 per barrel, he committed to a $500 million order of diesel. As the fuel sailed towards Nigeria, the global financial crisis erupted. Otedola watched, powerless, as the price of his cargo plummeted, eventually crashing to $37. The disaster was compounded by a severe naira devaluation, which dramatically inflated the cost of repaying his dollar-denominated debts. In a matter of weeks, the billionaire was staring into an abyss, saddled with a monumental debt of approximately N220 billion – a sum that threatened the stability of the Nigerian banks that had lent to him.

Yet, an “inner voice” is not what a prudent commodities trader relies upon; they rely on hedges and risk management – tools Otedola glaringly ignored. Later in the book, he attributes this catastrophic miscalculation to a lack of “astute advisers” who might have warned him of the risks. But this explanation rings hollow. His real failure was far more fundamental: a staggering, unhedged bet that left him doubly exposed to the volatile swings of global oil prices and the precariousness of the Nigerian naira. His admission that he believed he would “still be OK” even as prices fell to $110 is perhaps the most revealing detail of all. It is a tacit admission of the astronomical margins he enjoyed – margins so vast they are unthinkable in a truly competitive market for a low-margin commodity like diesel. (Much later in the book, he casually offers an “illustration” where diesel costs N20 per litre and sells for N70 – a staggering N50 margin. One can only hope, for the sake of Nigerians, that this was indeed merely an “illustration.”) This was not mere complacency but the illusion of invincibility forged by years of government-conferred advantage. He had come to believe that the winds of high profit, filled by monopoly rents, would never truly turn into a storm.

The consequences of this recklessness reverberated far beyond his own balance sheet. Zenon’s debt effectively made Otedola the single largest debtor in the Nigerian banking sector. His obligations threatened the stability of at least five major financial institutions, the very banks in which he had once been a prominent shareholder. He had become, by definition, a systemic risk to the nation’s economy.

‘Embargoed,’ Court Bans Man From Having Girlfriend

Govt Backs Off, Appoints K1 Ambassador, Frees Comfort of Criminal Charges.

Petrol Politics Worsens As Dangote Presses Tinubu To Ban Fuel Imports

To Help Lower Blood Pressure, Here Are 5 Things to Do Before Bed

His passing mention of AMCON as a “lifeboat in the Nigerian economic crisis” is a masterful understatement. The government, through the Asset Management Corporation of Nigeria (AMCON), orchestrated a full-scale rescue of the financial system from the crisis his gamble had helped create. AMCON purchased his toxic debt from the banks for N141 billion, forcing the lenders to absorb a haircut of over N80 billion. After months of negotiation, a settlement was reached wherein Otedola cleared this reduced obligation by handing over a vast portfolio of assets – nearly all his real estate and shareholdings, save for his stake in Forte Oil, homes in Abuja and Lagos and a personal office. The state, which had provided the advantages that built his fortune, now intervened to absorb the catastrophic losses that resulted from his risk. To be fair to him, whatever arrangement enabled this resolution, he did ultimately clear his debts – a point of pride he reiterates throughout the book, and more than can be said for many other beneficiaries of AMCON’s intervention who have remained wards of the state for over a decade.

There is no doubt that this period was profoundly traumatic for Otedola, and he writes with striking vulnerability about the personal and financial toll of the collapse. Yet, in the cold light of history, his narrative must be measured against a crucial, unignorable fact: his recovery was not solely a story of individual grit. It was underpinned by a massive state intervention. By 2013, the AMCON settlement had rendered him officially debt-free, absolving him of the crippling N141 billion obligation. This government-engineered reset provided the essential platform for his comeback. Freed from this burden, he could focus his efforts on Forte Oil, and in a dramatic turnaround, the value of his remaining 34% stake surged in subsequent years, ultimately restoring – and then exceeding – the vast fortune he had lost. His remarkable recovery is therefore a dual testament: to his personal resilience, certainly, but equally to the state’s role in socialising the catastrophic cost of his risk, ensuring his survival and enabling his return.

Only the cynical win

Throughout the memoir runs a cynical thread common to Nigeria’s business elite: a belief that success is secured in the corridors of power, not in the marketplace. Otedola recounts the story of Chief Adebowale, who, following a government ban on imported lighting in the 1980s, launched a venture to manufacture fluorescent lamps and bulbs in Nigeria. Otedola père, Sir Michael, invested N2 million in the enterprise. The government then undermined its own policy by granting import licences to Indian competitors, and Sir Michael lost his entire investment. The lesson Otedola fils took from the episode is starkly revealing: “If Adebowale had been visible in the corridors of power,” he writes, “he could have pushed for government to stick with its protectionist policy.” The lesson was not to innovate or compete, but to lobby harder.

This conclusion, as depressing as it is predictable, exposes a foundational ailment of the Nigerian economy. The entrepreneurial imagination is narrowed to a single strategy: securing government favour. The possibility of actually mastering the well-established technology and producing a competitive light bulb – of winning through efficiency and innovation – seems not to have been seriously considered. The story becomes a perfect metaphor for a stagnant system: how many hands, in government and business, does it take to change a light bulb? In Nigeria, the answer is too many, all pulling levers of influence instead of simply building a better bulb.

This pervasive cynicism is, in part, a product of the environment itself – a system where Otedola and his peers are not just architects but also victims. Their world is a kind of brutal, zero-sum arena where every gain is perceived as another’s loss. The memoir is saturated with this siege mentality; Otedola repeatedly returns to the spectre of “haters,” “vile rumour mongers,” and jealous rivals perpetually scheming against him. His triumphs, therefore, are measured not just in wealth, but in the visceral pleasure of defeating these enemies. This is starkly captured in his decision to name his final ship the Zenon Conquest, boasting that “I had conquered them all! Let the haters go and eat grass.” From this vantage point, success in Nigeria demands a ruthless street savvy and a relentless will to dominate and destroy one’s adversaries in an existential struggle.

Big man, small country

Herein lies the central paradox of Nigerian success: one can “make it big” while the country itself remains small. The fortunes amassed by its titans are too often uncorrelated with – and at times actively counter to – national progress. This memoir, in its own way, embodies that disconnect. It is replete with advice and “business lessons,” yet few would realistically pave a path to billion-dollar wealth in today’s Nigeria. But perhaps that is its unexpected virtue. The counsel Otedola dispenses – avoid philandering, don’t tolerate fraudsters and cheats, cherish family, give generously – is sound, humane, and universally meaningful, even if his own life reflects a more complicated reality.

We should read this book, then, not as a manual for spectacular enrichment, but as an invitation to redefine success altogether. The true value of these pages lies not in their prescription for making it big, but in their quiet advocacy for making it better. You will not build a billion-dollar empire in Nigeria by these principles, but you will build a life of meaning. You will not conquer markets, but you will contribute to your community. In the final accounting, the only success that truly enlarges us all is not measured in private fortunes, but in our collective progress.

Making it better ultimately proves far more rewarding than merely making it big. But then, I would say that – spoken like the poor man I am.

Platforms Africa