The Secretary-General of the African Continental Free Trade Area (AfCFTA’s) announced that the continent will soon have its own uniform payments and settlement platform to ease the burden of doing business in 42 currencies. Wamkele Mene revealed the plans at a webinar organised by the ruling South African ANC’s Progressive Business Forum on the AfCFTA on Friday. ‘Working with the Afreximbank [the African Export–Import Bank established to finance, promote and expand intra-African and extra-African trade] we are developing a pan-African payments and settlement platform to overcome this challenge of…

Read MoreCategory: Money and Stocks

Naira falls at official market, Slides to N410.50 per $1

Nigeria’s unit of exchange, Naira, fell marginally against the U.S dollar at the I&E window of the foreign exchange market on Tuesday, dipping to N410.50 to a dollar. This, data posted on the FMDQ Security Exchange showed, however, remained stable at the black market. Naira, Africa’s most populous country’s currency closed at N410.50 at the trading session of the I&E window, this represents N1.20 or 0.29 per cent devaluation from N409.30 the rate at which it closed at the previous session on Thursday, last week. The local unit experienced an…

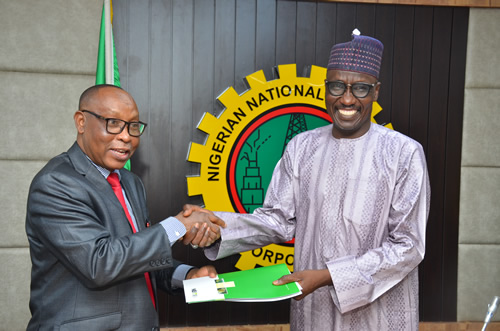

Read MoreAfreximbank’s $1bn fund for PH Refinery Rehab, fruit of transparency- Kyari

. As NNPC, NEITI Renew Commitment to Deepen Transparency The Nigerian National Petroleum Corporation (NNPC) on Thursday declared that it secured financing agreement for the rehabilitation of the Port Harcourt Refinery by the African Export Import Bank (Afreximbank) as a fruit it reaped from its transparency and accountability. Though the rehabilitation is to gulp $1.5 billion, the financing deals secured from the Afreximbank, Platforms Africa gathered, is $1 billion. Group Managing Director of the NNPC, Mallam Mele Kyari, said while playing host to the management team of the Nigeria Extractive…

Read MoreNigeria secures $1bn Afreximbank loans for Port Harcourt refinery’s repair

Here is Mele Kyari’s account of real reason Nigeria preferred $1.5bn PH refinery repair to new refinery’s construction African Export-Import Bank (Afreximbank), as a reliable lender, has agreed to raise $1billion out of the $1.5 billion for the rehabilitation of the Port Harcourt refinery. Group Managing Director, Nigerian National Petroleum Corporation, NNPC, Mele Kyari, who disclosed this, described the recently approved rehabilitation exercise of the 210,000 barrels per day capacity Port Harcourt Refinery as a worthy undertaking embarked upon after diligent consideration and in strict adherence to industry…

Read MoreNigeria’s GTBank Mulls Expansion, Acquisition of Kenyan Lender

Guaranty Trust Bank Plc, Nigeria’s biggest lender by market value, plans to acquire a Kenyan lender as part of its expansion on the continent, according to the managing director, Bloomberg has reported. “I think the place we will still like to do business or do an acquisition is Kenya,” Segun Agbaje, the lender’s chief executive said at an investor call in Lagos, without giving a time-line for the acquisition. The Lagos-based lender already has offices in 10 countries outside Nigeria including Kenya. It wants to increase the contribution of…

Read MorePolaris Bank commences Extra N5 payment for Dollar remitted to Nigeria

Polaris Bank has commenced implementation of the regulatory Central Bank of Nigeria (CBN)’s extra N5 for every Dollar received into domiciliary accounts or as cash over the counter. The acting Managing Director/CEO of Polaris Bank, Mr. Innocent C. Ike disclosed that “growing evidence has shown a positive relationship between diaspora remittances and economic growth and as such, the Bank will continue to contribute its quota to enhancing economic development in the country”. The Polaris Bank CEO further explained that, the decision is in line with the CBN’s directive and fully…

Read MorePolaris Bank rewards 2nd millionaire, 60 winners in ‘Save & Win’ Promo

Ikechukwu Bartholomew Obiefuna, a customer of Polaris Bank’s Okeke Street branch, Onitsha in Anambra State has emerged the second millionaire at the 2nd draw of the Bank’s ongoing nationwide Save & Win promo. A set of 60 lucky customers from across the six geo-political zones, also received N100,000 each, as consolation cash prize during the draw which held at the Bank’s headquarters in Lagos. The winners emerged through a transparent draw witnessed by officials of the Federal Competition and Consumer Protection Commission (FCCPC); National Lottery Regulatory Commission (NLRC) and representatives…

Read MoreCrowdyvest exits EMFATO Holdings, leaves crowdfunding space

EMFATO Holdings (owners of Farmcrowdy and investors in Plentywaka) has announced the exit of one of its portfolio companies – Crowdyvest, following up on new investments into the startup to grow as a digital savings company in Nigeria Launched just over a year ago, Crowdyvest, a statement sent to Platforms Africa read, has over 10,000 members who have used opportunities on it’s platform to sponsor projects in Agriculture, Real Estate, Transportation, Health and Education sectors. The company was previously led by its Co-founder & CEO, Onyeka Akumah now has…

Read MoreCryptocurrencies: Why Nigeria is a global leader in Bitcoin trade

More cryptocurrency trading goes on in Nigeria than almost anywhere else in the world, reflecting a loss of faith in more traditional forms of investment, as Ijeoma Ndukwe reports. Tola Fadugbagbe recalls moving to Lagos from his small south-western town 10 years ago with dreams of brighter prospects. Instead, the 34-year-old ended up in a series of odd jobs earning the minimum wage to survive – a typical story for many young Nigerians who are just trying to get by. It was not until 2016 that online adverts…

Read MoreNigerian Banks borrow N15.95bn from CBN in one Month + FULL LIST

Commercial Banks in Nigeria borrowed N15.95 billion from the Central Bank of Nigeria (CBN) in the Standing Lending Facility window in November, 2020. The CBN, which confirmed this in its latest monthly economic report for November, maintained that the Deposit Money Banks have, with this, continued to reduce their borrowings due to excess liquidity in the system. Part of the report read, “Deposit Money Banks and merchant banks continued to access the standing facilities window to square liquidity positions in November 2020. “The trend at the CBN standing facilities…

Read More