The Central Bank of Nigeria (CBN) has directed OPay, Palmpay, Kuda Bank, and Moniepoint to stop onboarding new customers until further notice over alleged illegal forex dealings.

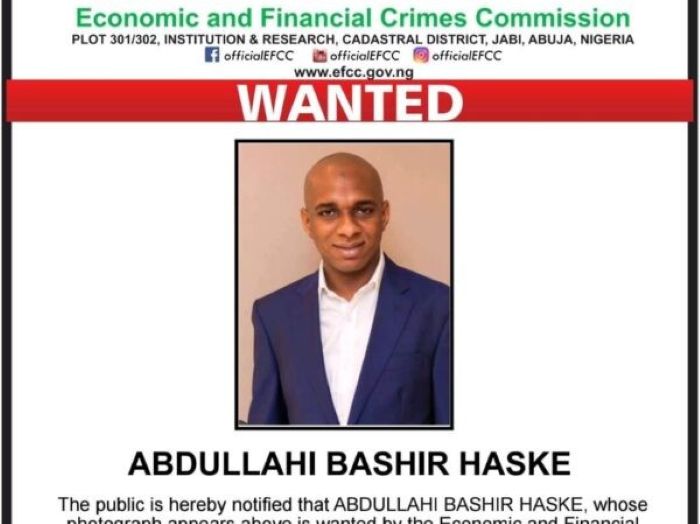

Recall that a Federal High Court in Abuja had earlier approved an interim order requested by the Economic and Financial Crimes Commission (EFCC) to freeze at least 1,146 bank accounts owned by various individuals and companies allegedly involved in illegal foreign exchange transactions.

Justice Emeka Nwite, in a decision on the ex-parte motion presented by the anti-graft agency’s lawyer, Ekele Iheanacho, also approved the commission’s request to complete the investigation within 90 days.

Meanwhile industry players stated that the latest directive by the CBN may have been misdirected given that most of the accounts involved were commercial bank accounts.

READ ALSO

BREAKING: NFF Appoints New Super Eagles Head Coach

Power: Enough Of Sponsored Campaign Against Adelabu – CSO

JAMB Releases 2024 UTME Results For 1.9 Million Candidates

JUST IN: Gov Obaseki Raises Minimum Wage To N70,000 In Edo

“I can confirm that 90 per cent of the accounts involved in the illegal forex trading are commercial bank accounts while fintech accounts were just 10 per cent. Why has the CBN not asked the banks to stop onboarding new customers? We have a general problem, coming for fintechs is just like looking at the easy prey,” one of the sources said.

According to one fintech industry source who would not want to be named, this shows that there is a stronger and better relationship between the banks and the CBN compared with fintechs.

“In terms of KYC, the fintechs are doing better than the banks, but all eyes seem to be on the fintechs whenever the issue of KYC occurs.

Platforms Africa